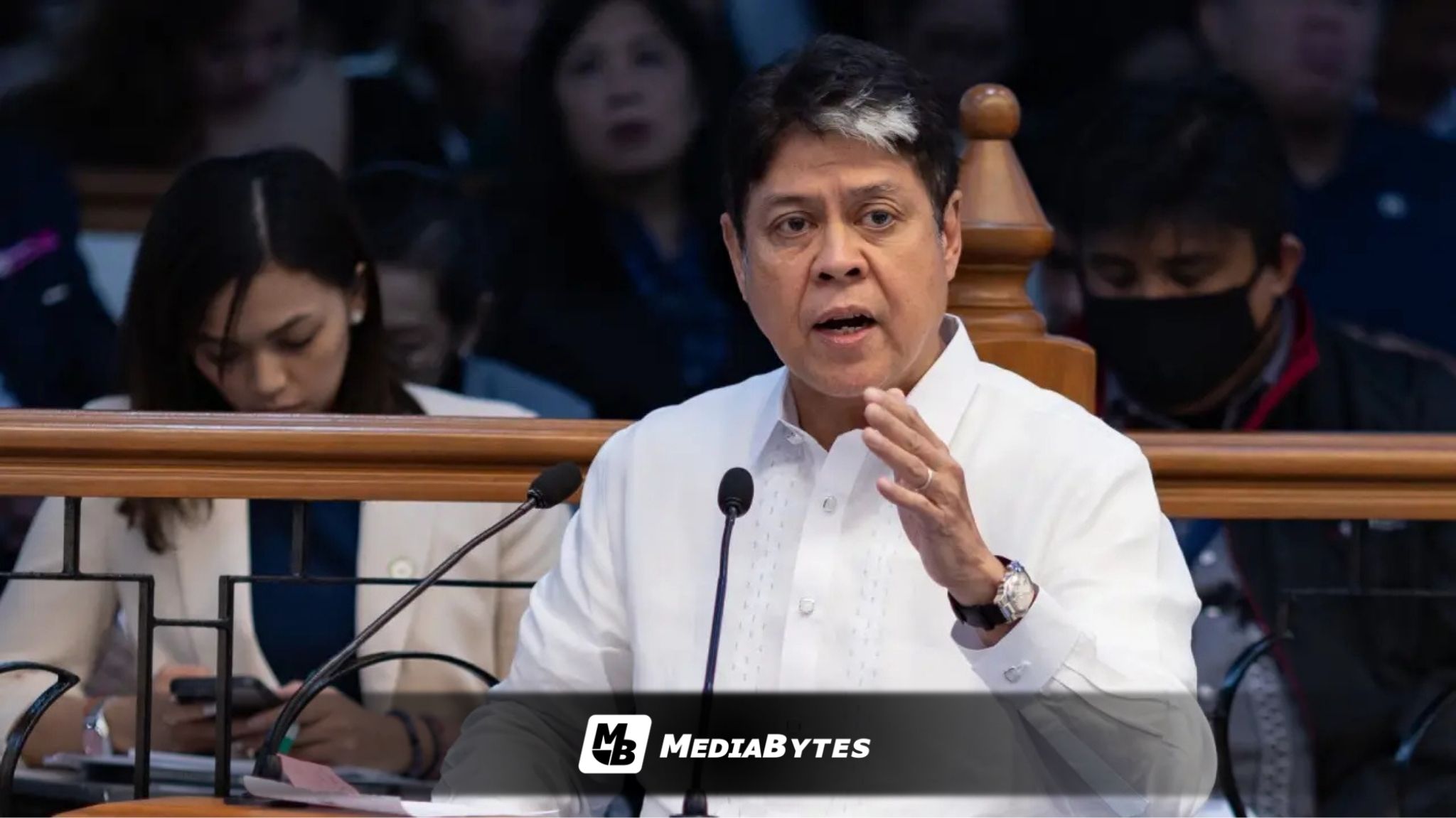

Senator Kiko Pangilinan is pushing for the abolition of the travel tax imposed on Filipinos departing the country, arguing that the levy makes overseas travel less accessible, particularly for those with limited financial means.

Pangilinan noted that current travel tax rates amount to ₱2,700 for first-class passengers and ₱1,620 for economy class travelers, adding to the overall cost of international trips.

He said the charge places an unnecessary burden on Filipinos and may restrict their ability to travel abroad — a right protected under Article III, Section 6 of the 1987 Constitution.

The proposal is outlined in Senate Bill No. 1843, which seeks to repeal the travel tax collected under Presidential Decree No. 1183, as amended, and Section 73 of Republic Act No. 9593, also known as the Tourism Act of 2009.

In the bill’s explanatory note, Pangilinan argued that scrapping the tax could help spur international travel and stimulate related economic activity in tourism and transportation.

“By lowering the cost of international travel, we expect to stimulate passenger volume, increase spending on transport, accommodation, food, and services, and generate positive spillovers across the economy,” the measure stated.

Beyond economic gains, the proposal also cited broader social benefits, saying that increased travel would promote stronger people-to-people exchanges and enhance the Philippines’ position as a competitive and accessible destination.

Instead of relying on travel tax collections, Pangilinan proposed that programs currently funded by the levy be integrated into the Department of Tourism’s budget, particularly for the Tourism Infrastructure and Enterprise Zone Authority (TIEZA).

The bill further provides that tourism and cultural initiatives may also be supported through the Commission on Higher Education’s Higher Education Development Fund and the National Commission for Culture and the Arts’ National Endowment Fund for Culture and the Arts.