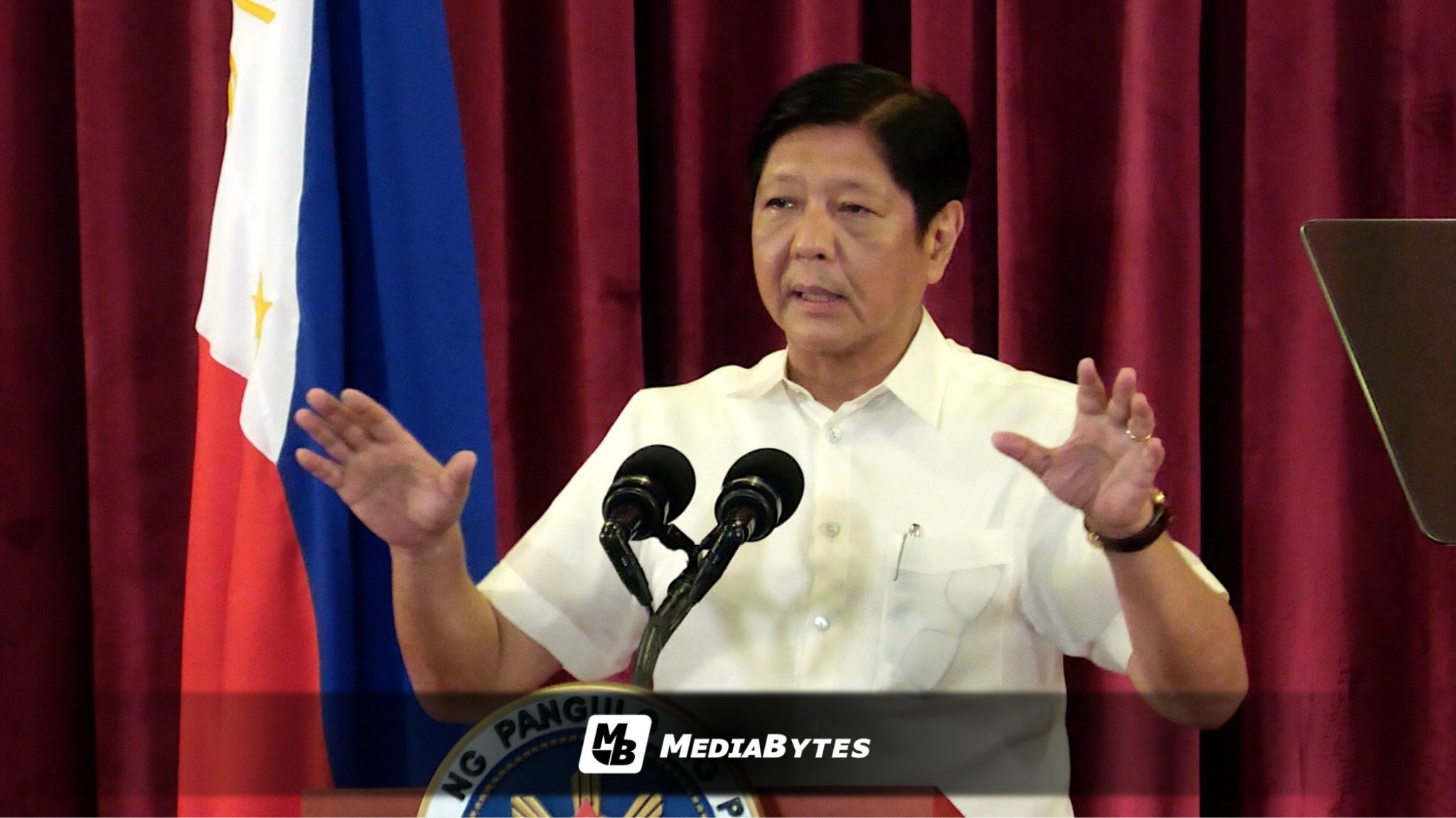

President Ferdinand “Bongbong” Marcos Jr. has received updates on the Bangko Sentral ng Pilipinas’ (BSP) monetary policy actions and the country’s economic outlook, the Presidential Communications Office (PCO) said Wednesday.

The briefing came after Marcos met BSP Governor Eli Remolona Jr. at Malacañan Palace on Tuesday.

According to the PCO, Remolona reported that the Monetary Board (MB) decided in December 2025 to cut the BSP’s key policy interest rate to 4.5% from 4.75% in October, aiming to support economic activity amid easing inflation.

Rates on overnight deposits were lowered to 4% from 4.25%, while overnight lending facilities were reduced to 5% from 5.25%.

“In its latest monetary policy meeting, the BSP projected that economic growth would remain modest through the first semester of 2026 before a rebound in 2027 that is partly supported by earlier policy easing,” the PCO said.

The BSP noted its easing cycle is nearing completion, signaling a more cautious approach as it monitors domestic and global conditions.

The meeting also tackled the World Bank’s outlook, which foresees recovery in the next two years.

“The World Bank projected a boost in private consumption if inflation stays low, employment remains strong, and monetary easing lowers interest rates, which would encourage businesses and households to spend and invest more,” the PCO added.

Investment is expected to rise with the resumption of public infrastructure projects and liberalization reforms improving the business climate.

The World Bank emphasized that inclusive growth requires low- and middle-income regions to outpace Metro Manila in development.